Financing for sustainable development

The modernisation of official development assistance (ODA)

|

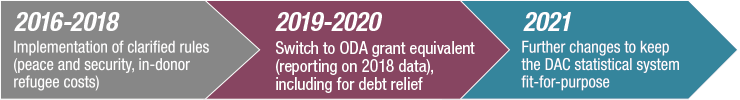

Development Assistance Committee (DAC) launched the modernisation of its statistical system in order to improve its accuracy while reflecting the changes in the development co-operation sector, such as the growing importance of other providers – non-DAC providers or philanthropic foundations -, the diversification of financial instruments for development, or the increasing overlap of development co-operation policy objectives with those of other sectors such as migration and security. |

The modernisation of Official Development Assistance (ODA)In the process, the DAC took a series of decisions at its High Level Meetings (HLM) in 2014, 2016 and 2017 with regard to the measurement of concessional loans to the public sector, private sector instruments (PSI), peace and security expenditures, and in-donor refugee costs.

The new statistical framework:

Click here for Frequently Asked Questions about the modernisation of ODA. |

||||||||||||

Clarification of eligibility rulesAmbiguities in reporting rules led to inconsistent interpretation and reporting by DAC members on both peace and security-related expenditures, and on in-donor refugee costs. Peace and security effortsIn 2016, the DAC agreed on updated rules for the eligibility of peace and security expenditures. This was to better recognise the marginal, but actual developmental role that military actors sometimes play, notably in conflict situations, while clearly delineating it from their main peace and security function.

In-Donor refugee costsIn 2017, the DAC agreed to clarify the reporting directives for assessing what may be included or not in ODA – and provide its members with a blueprint to use when accounting for the costs of assisting refugees in donor countries. The changes aim to improve the consistency, comparability and transparency of DAC members reporting of ODA-eligible in-donor refugee costs. |

||||||||||||

Introducing the “Grant equivalent”A fairer method to record ODAOECD Official Development Assistance (ODA) Statistics: Introducing the grant equivalent ODA can take the form of (i) grants, where financial resources are provided to developing countries free of interest and with no provision for repayment, or (ii) soft loans, which have to be repaid with interest, albeit at a significantly lower rate than if developing countries borrowed from commercial banks. Until recently, grants and loans were valued in the same way: by recording the flows of cash that were granted, or the face value of loans that were lent to developing countries, deducting any repayments on the loans. This “cash basis” or “flow basis” method, has been used to produce ODA headline figures until 2018 (reporting on 2017 ODA spending). The method was simple, but it did not reflect actual efforts by donor countries: a grant represents a bigger effort than a loan; and a loan with a very low interest rate and a long repayment period represents a bigger effort than a loan with a higher interest rate and a short repayment period. That is why DAC members decided, at their 2014 High-Level Meeting, to introduce a new way of measuring aid loans, so as to better reflect the actual effort by donor countries – and their taxpayers: only the “grant equivalent” of loans would now be recorded as ODA. The more generous the loan, the higher the ODA value. Instead of recording the actual flows of cash between lender and borrower, the headline measure of ODA is based on the loans’ “grant equivalents”. This provides:

Making grants and loans comparable: calculating the grant element and the grant equivalentMoney today is worth more than the prospect of the same amount in future. Any comparison of money now and in the future must take account of the rate at which money loses value. A sum of money in the future can be reduced to its value today by applying a discount rate. A discount rate is an interest rate applied in reverse: it applies tomorrow’s value to today’s money. Grant element calculations use discount rates to reduce the expected future reflows from a financial transaction to the value they would have today. If the value of expected future reflows in today’s money is lower than the amount extended today, then the difference represents a “gift”. This gift portion is called a grant equivalent if expressed as a monetary value, and a grant element if expressed as a percentage of the amount now extended.

The question of debt reliefAt the 2014 High Level Meeting it was agreed that changing the ODA measurement system from net flows to a risk-adjusted grant equivalent system would also change the basis on which debt relief of ODA loans was reported. The DAC reached a consensus on the treatment of debt relief on a grant equivalent basis in 2020, thus two years after the implementation of the grant equivalent as the standard for measuring ODA, noting that no major debt reorganisation occurred in 2018 and 2019. The agreement is an important step towards completing the modernisation of ODA.

The question of private sector instrumentsAt the February 2016 DAC High Level Meeting, members agreed on the principles to better reflect, in ODA, the donor effort involved in the use of private sector instruments. However, despite efforts by all parties, the implementation rules to report private sector instruments in ODA have not yet been agreed, primarily due to disagreement over the discount rates to be used in calculating the grant equivalent of loans to private sector companies (PSI loans), equity investments, mezzanine finance and guarantees. Therefore, DAC members have agreed on how to report their 2018 private sector instrument flows in ODA (based on prior years’ decisions and procedures), by applying either the institutional or instrument approach (until such time as the details of all decisions on private sector instruments are agreed):

The total ODA figure

|

||||||||||||

Beyond ODA: Total Official Support for Sustainable Development (TOSSD)The measurement, total official support for sustainable development (TOSSD), is developed to promote greater transparency over the full array of officially supported development finance provided in support of the 2030 Agenda for Sustainable Development – including resources provided through South‑South co-operation, triangular co-operation, multilateral institutions and emerging and traditional donors. TOSSD complements ODA by increasing transparency and monitoring important new trends that are shaping the international development finance landscape. |

Related Documents